How to Sell w/out "Selling" - A Guide to Closing Sales w/out Looking Like an Insurance Salesperson

- Brookelle Hunter

- Sep 3, 2025

- 6 min read

Your Comprehensive Guide to Closing Sales without Looking Like Just another Insurance Salesperson

When I started working as an appointment scheduler at Engagex in 2017, a response that I got daily (if not more than that) was,

“I don’t need any more insurance.”,

“I don’t want to come in just to be sold more insurance.”,

“I’ll only come in if it’s a review - I don’t want to buy more insurance.”

And other responses along those same lines.

Generally speaking, people don’t like to be sold to.

This can be frustrating to you as an agent because customer insurance review meetings are one of the most efficient ways to identify opportunities to sell new policies to your existing customers.

Selling new policies may even be your primary motivator to meet with your customers in the first place!

And as you know, sometimes your clients are at risk because they have too little coverage or recently had a change in their life that requires a new or updated policy.

To get them the coverage they need, you have to up-sell them.

However, the customer insurance review meeting is NOT the time or place to try to sell them the new policy.

Yes, you read that right.

The customer insurance review meeting is NOT the time or place to try to sell the new policy.

So, if you shouldn’t be hard-selling during the meeting, how are you supposed to upsell your customers?

This blog post is a detailed guide to up-selling/cross-selling your customers without coming across as an insurance salesperson.

Let’s get into it.

You’ll need to take five steps for this process to work:

Create educational content about the different types of coverage your offer

Utilize the Needs Assessment Form

Conduct the review meeting - Investigate & Educate

Action Items

Follow-up & Close the Sale

Something important for you to keep in mind: The purpose of the customer insurance review meeting is to investigate and educate.

Step 1 - Create Educational Content

The first step - creating educational content - will take some work up front, but once you’ve made the content, you’ve got it for all your customer insurance review meetings!

You’ll only need to go back periodically to make minor changes and updates.

Don’t let this part scare you - it will be worth your time.

As a captive agent, your company might already have this content available for you!

Educating your clients about their current coverage, risks, and solutions to those risks will help them feel the need and recognize the value of a new policy.

Here are some things to consider when creating educational content that sells policies:

The most common media for educational insurance policy content will be:

Electronic document/article form (this could be a page on your website or blog)

Physical handouts like a pamphlet or flyer

Video

If you have the capabilities to create videos explaining your policies, it’s a good idea to do so.

Once you have every product outlined in multiple formats, you will be ready to offer the most helpful deliverable to your client.

If your client prefers video, send a link to your video (you can easily host it on YouTube or Vimeo).

If they want a physical pamphlet, hand them a pamphlet.

If they want an email with a link to an article, be prepared with that too.

What products should you create educational content for?

It will be beneficial to create content for each product you offer.

Go through each insurance policy category and subcategory, identify the policies your customers might be most interested in, and start there.

For example:

Category: Auto

Piece 1: Liability

Piece 2: Uninsured Motorist

Piece 3: Medical

Piece 4: Comprehensive

Category: Home

Piece 5: Home/Rental

Piece 6: Separate Structures

Piece 7: Contents

Piece 8: Additional Living Expenses

Piece 9: Liability

Piece 10: Guest Medical

Create an educational piece for each policy you offer so that whenever a customer asks for more information, no matter what it is, you will have a quick deliverable answer.

With each educational piece you create, you will want to follow 4 steps:

Explain the function of the coverage and the circumstances under which the coverage is needed. Explain any terms that might be unfamiliar to your client. Explain any numbers or figures involved in the policy.

Give a specific, real-life example.

Clarify the benefits of having the policy

Consider Frequently Asked Questions

As you meet with your existing clients to review their policies and discuss their needs, take note of questions that frequently come up. These questions will give you a good idea of the most important things to include in your educational content. Periodically, you should review your content to ensure the information contains the answers to these questions.

As you allow your clients to learn why they need specific additional policies for themselves, you will have greater success cross-selling more policies.

Step 2: Needs Assessment Form

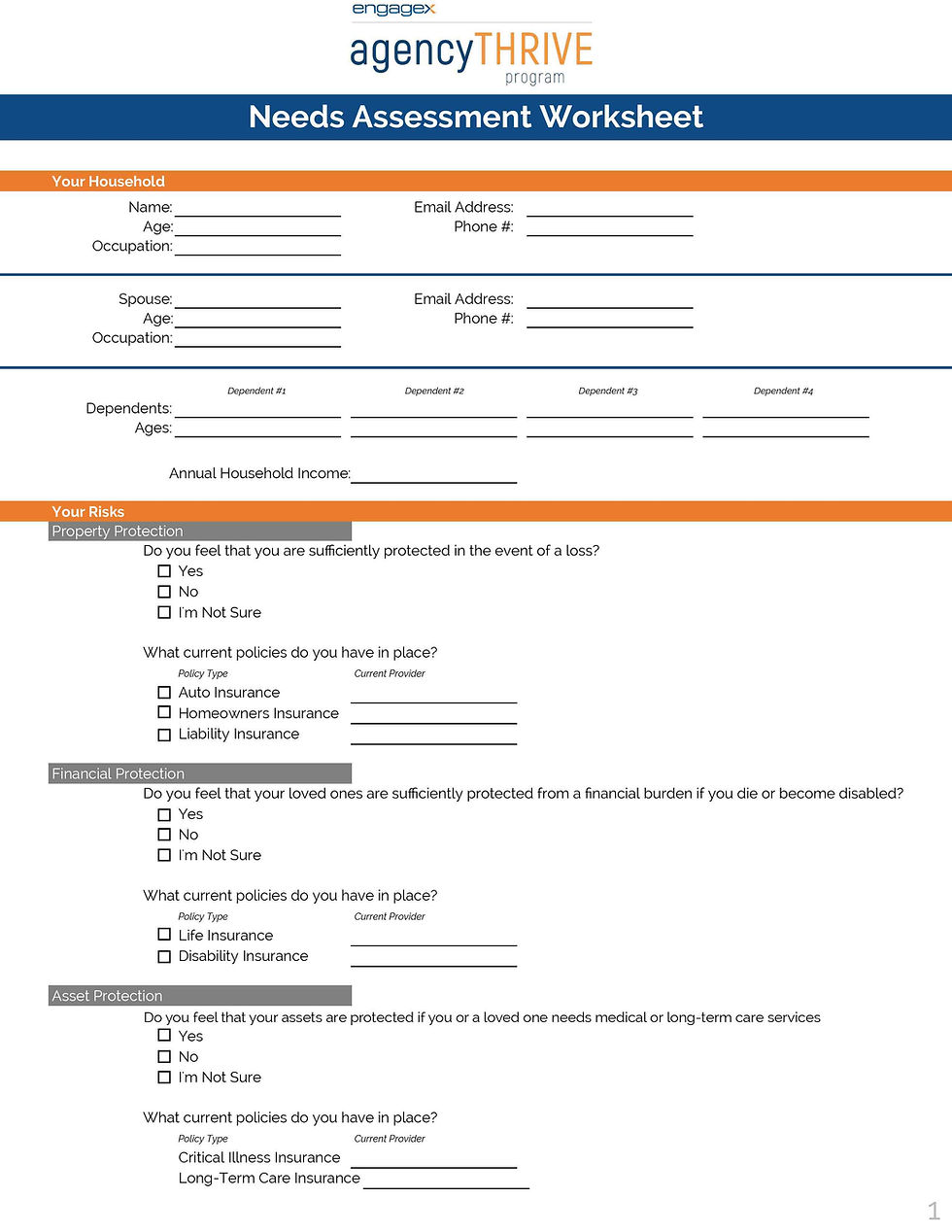

A tool that is often under-utilized is the customer needs assessment form.

This form is a simple questionnaire about the risks your clients face compared to their current coverage.

Functions of the Needs Assessment Form:

Identifies current risks/needs

Gathers info - long-term goals, education plans, retirement, etc.

Identifies top concerns of the client

Notes any recent life changes

Benefits of the Needs Assessment Form:

Gives you (the agent) a clear picture of the client

Helps you (the agent) prepare for the meeting

Aids in the "investigate" portion of the customer insurance review

Gets your client thinking and in the right mindset for the review

The Needs Assessment form helps you investigate to identify gaps, overlaps, risks, and solutions to those risks.

Have your clients complete the form before insurance review meetings (or at the beginning of the appointment).

Download the Free PDF here:

Step 3: Conduct the Review Meeting

Remember: Investigate & Educate

Here’s a brief outline for you to follow for the review meeting - make sure to be present and tailor the appointment to the client’s needs:

1. Naturally, start the discussion with a few minutes of pleasantries

Discuss customer’s interests/hobbies

Ask about their goals and desires

Be natural and build a genuine relationship

Getting to know your clients is far from a waste of time.

2. Verify contact information

3. Review the completed Needs Assessment Form

If they haven’t done it, take a minute or two to fill it out with them by asking them the questions on the form

4. As you work through the review, you’ll discuss each type of insurance coverage.

To discuss it effectively, educate them on the purpose of the coverage and instances in which it has been beneficial.

Next, review their current coverage and whether or not it’s sufficient in your expert opinion.

Next, confirm whether or not the client is satisfied with their current coverage.

After discussing each type of insurance, discuss potential discounts your client is eligible for.

This is typically the most exciting part of the review for your client and will reinforce the value you’re providing them.

Solely giving the customer a discount without letting them know won’t help your retention - your customers need to know that you’re providing them a deal for them to recognize the value YOU provide.

5. After reviewing all of their coverage, let your client know about any new products you have available that would apply to them.

6. Review your action items

Make sure you’re both on the same page about any updates to their coverage.

7. Review their long-term goals that you can assist with

8. Close

Thank them for their time, and let them know that you’ll be in contact shortly to follow up on any action items you’ve identified, along with any educational info for them to review.

Step 4: Update Information & Complete Action Items

Update your customer’s file with any additional information you collected during the review.

This could include a spouse’s name, employment details, or life changes.

Update any changes to their policy discussed in the meeting.

If you need to increase or decrease their coverage, ensure you take the steps necessary to get that done immediately.

Complete any action items or tasks requested or brought up during the meeting.

These could be things like sending the customer a copy of their policy or checking on the status of an open claim.

From your notes, you will be able to identify educational content to send your customer that relates to their needs and interests.

You might have already provided them with the content they need during the meeting, which works, too!

Step 5: Follow-up & Close the Sale

One week after your meeting with each customer, give them a call to see if they have reviewed the educational materials you sent with them.

Ask them if they have any questions about it.

Give them a quote for that specific line of coverage and give a recap of why they would be interested in it.

This is where you will naturally sell new policies.

Remind your customers that you will invite them back for another appointment in about a year.

Say something like “Mrs. Jones, how about I give you a call next September so we can schedule our next appointment to meet again in October”.

This way it's no surprise to your customer when you try to set up another appointment.

Remember that consistency is the key to having a successful customer insurance review program.

You will need to meet with your customers each year to successfully grow your agency over time.

Following the steps in this guide will help to shift your customers' views of you from an insurance salesperson to a trusted insurance advisor.

Are there other things you've done to help establish yourself as a trusted advisor rather than a salesperson? Let us know in the comments below! We'd love to discuss.

Comments